Three drug dealers have several thousand dollars of dirty money they want to launder. They bring their cash and a friend (with no criminal record) to the local casino in which it is now legal to play group blackjack via a mobile app. In this game, the house only takes a small rake and the majority of the pot goes to the player with the highest card total (without busting). After each of the three drug dealers cashes in some of his dirty money to get credits on the app, the three criminals sit in different parts of the casino and play extremely aggressive hands (splitting 10s, hitting on 17s, etc.) and routinely go bust, so as to let their fourth friend win. This new skill-based app has allowed a group of criminals to gamble together in the casino and launder their money (for a relatively small fee) without them ever sitting at the same table or otherwise interacting within the casino. It is the modern day equivalent of partners in crime betting on both black and red in roulette. This offsetting bets scenario presents new challenges for casinos' anti-money laundering programs.

Casino Money Laundering Red Flags Pictures

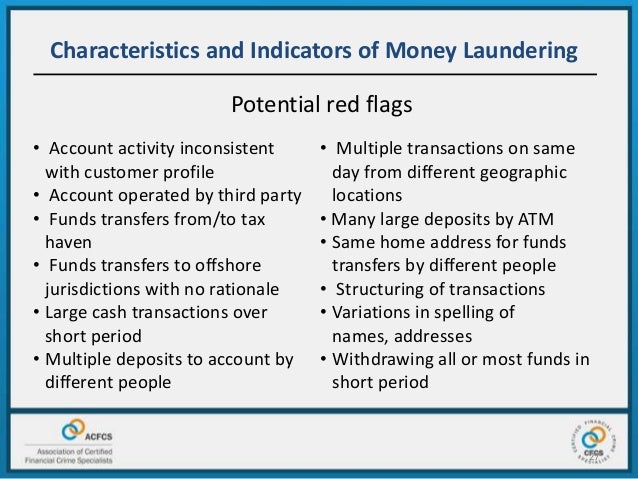

4 Red Flags of Money Laundering or Terrorist Financing by Lowers & Associates May 26, 2015 One of the most important aspects of BSA/AML compliance is the responsibility it places on regulated financial entities to report suspicious transactions. Bank Secrecy Act: Red Flags of Money Laundering Written by Shereefat Balogun, Regulatory Compliance Counsel So we all know that credit unions are required to file a Suspicious Activity Report (SAR) where a member appears to be engaged in illegal or suspicious activity. There are several red flags to look out for to help identify suspicious activities in casinos and online gambling. To prevent money laundering, be cautious of: Any person purchasing a large amount of chips with little to no gaming, then cashing out. Two or more customers each purchase chips in currency between $3,000 and $10,000. For additional guidance, see Casino or Card Club Risk-Based Compliance Indicators, FIN-2010-G002 (June 30, 2010) and Frequently Asked Questions – Casino Recordkeeping, Reporting and Compliance Program Requirements, FIN-2007-G005 (November 14, 2007) and FIN-2009-G004 (September 30, 2009), and Recognizing Suspicious Activity - Red Flags for Casinos and Card Clubs, FIN-2008-G007 (August 1, 2008). Crown Resorts was arrogant towards regulatory compliance and didn't properly act on money laundering red flags, an inquiry into the company suitability to run a new $2.2 billion Sydney casino has heard. The Barangaroo premises, slated to open in mid December, is under a massive cloud amid the NSW Independent Liquor and Gaming Authority probe.

Casino Money Laundering Red Flags Of America

Crown Resorts was arrogant towards regulatory compliance and didn't properly act on money laundering red flags, an inquiry into the company suitability to run a new $2.2 billion Sydney casino has heard. The Barangaroo premises, slated to open in mid December, is under a massive cloud amid the NSW Independent Liquor and Gaming Authority probe. The regulator is reportedly set to meet with Crown on November 18 to discuss whether to push back, or put conditions on, the casino's opening. Lawyers assisting the inquiry have argued Crown is not fit to hold the Barangaroo licence due to its poor culture, lack of risk management procedures and links to dodgy junket operators. In concluding her final submissions on Monday, counsel assisting Naomi Sharp said evidence across the hearings had shown Crown had an 'arrogant indifference' to regulatory compliance. '(There is a) culture of denial and an unwillingness to examine past failings. And ... a culture which has prioritised the pursuit of profit above all else,' she said. Counsel assisting Scott Aspinall said transactions uncovered during the hearings showed Crown was either ignorant or apathetic about the money laundering risks involving two subsidiary companies. 'It's open for you to find that money laundering did occur,' he told inquiry commissioner Patricia Bergin. He said money was moved through companies Southbank and Riverbank from 2014-17 by 'smurfing', a process of splitting up money in smaller deposits to avoid detection. There were also examples cash was deposited anonymously to those companies, he said. ANZ in 2014 raised 'red flags' with Crown about Southbank and Riverbank and eventually shut down their accounts with the bank. Mr Aspinall said Crown failed to properly investigate why, and the problems persisted for years. The lawyer representing Crown, Neil Young, is set to address the allegations in his closing submissions on November 16. Mr Young said CCTV vision aired at the inquiry showing a bag full of cash being unloaded at one of Crown's high-roller rooms in Melbourne was not definitive proof of money laundering. But he did concede it amounted to a 'suspicious matter'. 'We will also explain in our submissions that Crown has taken steps to prevent such events ever recurring,' he said. Many of Crown's cultural problems stem from the 'dubious tone' set by former executive chairman and major shareholder, James Packer, the inquiry has previously heard. Lawyers representing Mr Packer's company Consolidated Press Holdings, which holds a 36.8 per cent stake in Crown, will address the inquiry on Wednesday. Commissioner Bergin, who is expected to produce a final report by February, may recommend the licence agreement for the new casino be terminated, suspended, or have new conditions added. Australian Associated Press